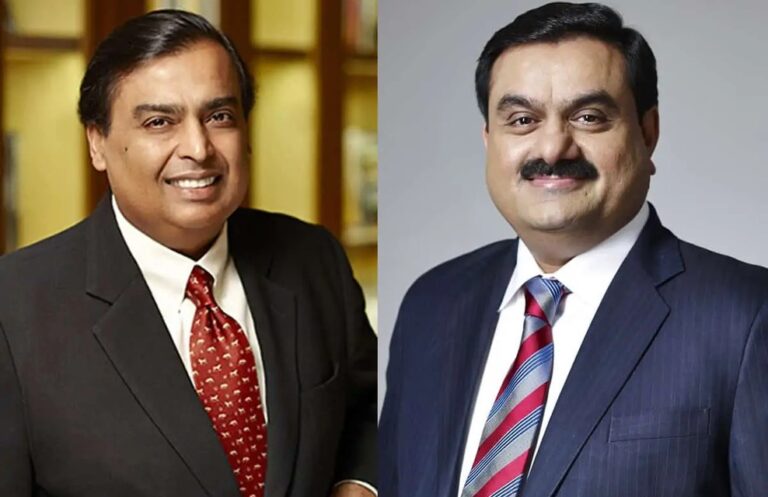

June 6, 2024 – In a dramatic turn of events, Indian stock markets witnessed their worst single-day crash in four years on Tuesday, leading to significant losses for the country’s two richest tycoons – Gautam Adani and Mukesh Ambani. The benchmark Nifty 50 index wipes out billions from the net worth of both business leaders. Indian billionaires Gautam Adani and Mukesh Ambani have suffered significant financial losses following the worst market crash in four years. The sharp decline in the stock market has eroded billions from their net worth, impacting their business empires and investor confidence.

Market Crash Impact:

- The market downturn was triggered by a combination of global economic uncertainties, rising interest rates, and geopolitical tensions, leading to widespread sell-offs.

Gautam Adani:

- Adani, chairman of the Adani Group, saw a significant drop in the value of his diverse portfolio, including sectors like energy, infrastructure, and logistics.

- The steep decline in Adani Group shares has resulted in billions of dollars being wiped from his net worth.

Mukesh Ambani:

- Ambani, chairman of Reliance Industries, experienced a similar financial hit. The conglomerate, which has interests in petrochemicals, telecommunications, and retail, saw its shares plummet, contributing to a substantial loss in Ambani’s wealth.

- Reliance’s ambitious expansion plans may face challenges as the company navigates this financial setback.

Impact on the Indian Economy

This major market crash raises concerns about the health of the Indian economy. The significant losses faced by Adani and Ambani, who are major players in key sectors, paint a worrying picture. It also has the potential to dampen investor confidence and hinder future investments.

Broader Implications

The market crash has not only affected these two magnates but has also sent shockwaves through the Indian economy. Investors are closely watching for stabilization measures and government responses to mitigate the impact.

For further updates on the financial markets and business news, stay tuned to HawkDaily.